The effects of changing interest rates, on both a global and national scale, has been a major talking point in recent news. Many investors worry about rising interest rates and their potential impact on investment returns, or cash flows of investment products such as REITs. Lately, however, the news has been shifting away from rising interest rates, and economists and investors alike have instead been speaking to stagnating or falling rates—especially when the Canadian yield curve became inverted earlier this summer and reached its lowest level since 2000.

The “Canadian yield curve” and its importance

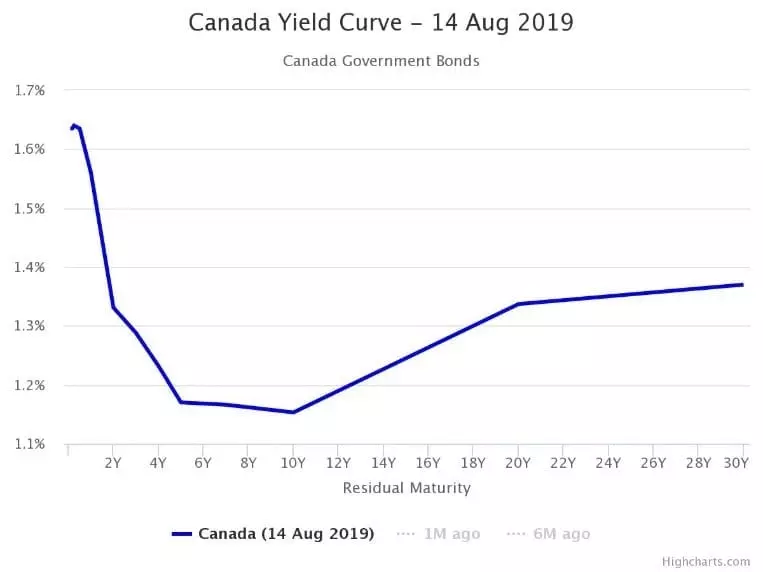

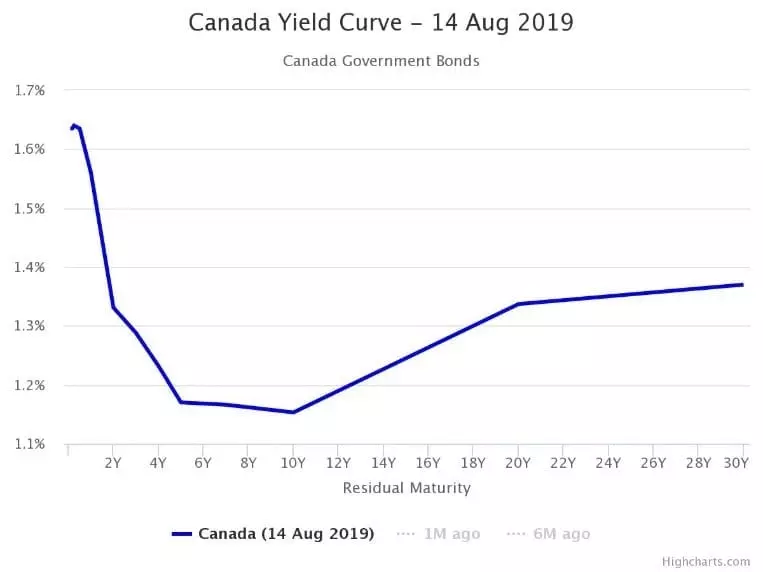

The “Canadian yield curve” is a chart depicting what Government of Canada bonds are returning to investors. Typically, the longer the bond term to maturity, the higher the yield should be, due to locking in money for longer periods of time. However, when shorter-term bonds begin to yield higher returns than longer-term bonds, the curve is said to be “inverted” (see below picture).

Economists historically tend to look at an “inversion” or “flattening” of the yield curve as a recession indicator and begin speculating that the Bank of Canada will cut rates further to help boost the economy. There are many factors that go into accurately predicting a recession, but the yield curve is seen as a leading indicator of the Canadian economy’s response to monetary policy.

Bank of Canada rates – are they rising or falling—and does it matter?

All three of Skyline’s REIT investments seek to ladder their mortgage maturities, in order to ensure that no more than 20% of the portfolio comes up for renewal in any given year. Laddering mortgages helps to reduce over-exposure in future years when returns and rates may not be as favourable. This also allows the REIT portfolios to have blended overall lending rates, which is especially helpful when moving into a rising interest rate environment.

“We have positioned ourselves as an attractive borrower with stable assets with the major lenders and have a strong borrowing history,” says Pete Roden, Vice President of Skyline Mortgage Financing Inc.

“In times of recession, lenders can become wary and may reduce their lending pot to mitigate their own risk. However, Skyline has built a strong reputation with the major lenders, and our stable market history has made us an attractive borrower, which should position us well if the lenders become more selective with their reduced pots of money.”

What impact might interest rates have on the Skyline REITs?

There are many factors that come into play when discussing market reactions, historical trends, and what the Bank of Canada may or may not do. Ultimately, however, there is no crystal ball to predict monetary or fiscal policy. For this reason, all three of Skyline’s REIT investments remain focused on their core acquisition strategy: buying in strong and vibrant communities, where value can be surfaced, where stable cash flow opportunities exist, and where economies of scale can be leveraged. By remaining committed to this acquisition strategy, the REIT have historically weathered economic uncertainty and remained stable in terms of unit values and distributions.

“Historically, when we have seen big volatility swings in the public market, the private sector has seen greater investment activity,” says Mike Bonneveld, Vice President of Skyline Asset Management Inc.

“Unlike the traditional investment opportunities offered in the public stock markets, the Skyline REITs are not valued by market sentiment or emotion. All three REITs are focused on intrinsic asset value; unit value is based on the underlying assets, instead of investor demand for the units. Thus, the REITs are positioned to offer a more consistent return in volatile environments.”

Looking forward

Skyline’s management teams continue to embody a forward-thinking management style where risk is mitigated as much as possible, and strong industry relationships continue to be fostered, thus strengthening the Skyline REIT investment products’ stable track records regardless of the economic environment. Regardless of where the yield curve goes, or whether or not the Bank of Canada decides to cut interest rates later this year, Skyline is confident that its three real estate investment portfolios are positioned for further strategic growth for the future.